Frequently Asked Questions

Everything you need to know about RT APP.

-

Q1: What is AML compliance?

Anti-money laundering (AML) compliance refers to the practices (a risk based approach to customer due diligence) applied by a business

to satisfy regulatory requirements put in place and enforced by national governments to mitigate the use of money to finance terrorism, as

well as prevent money made from criminal activity entering the economy.

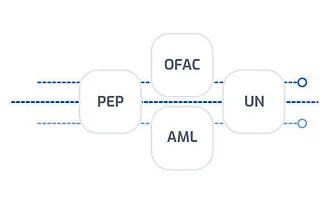

Sanction

A sanction refers to the seizure, freezing of assets or inability to participate in economic development imposed on a specific person, a business entity or an entire country by the United Nations Security Council. Specific nation-states may impose economic sanctions against other states to gain an advantage-these are outside the U.N’s purview.

- Global watchlists

- Regulatory bodies

- Law Enforcement agencies

PEP

While doing business with a Politically Exposed Person isn’t risky in of itself, understanding the level of exposure and influence a PEP has on altering or influencing a financial transaction (including susceptibility to bribery) allows your business to make informed decisions about the integrity with which a transaction is being initiated without exposing your business to corruption.

- Structured profiles

- Syndicated database

- Real-time updates

- RCAs enriched insight

Adverse Media

Adverse Media relates to information published incredible news publications whether as part of traditional (newspapers) or new (blogs, newsletters...etc.) media on politically exposed persons, human trafficking & war crime trials by the International Criminal Court, as well as daily news on financial crimes and criminal behavior.

- Credible news sources

- Enriched live profiles

-

Q2: How does ReThink DIDN meet the Customer Due Diligence requirement of a risk-based approach to compliance?

-

Q3: Why do companies need Customer Due Diligence?

-

Q4: What regulations are covered by the DIDN AML compliance program?

-

Q5: Which countries do you cover?